January 2024 Intown Atlanta Market Report

Bill Adams, Founder, Adams Realtors & Adams Commercial Real Estate

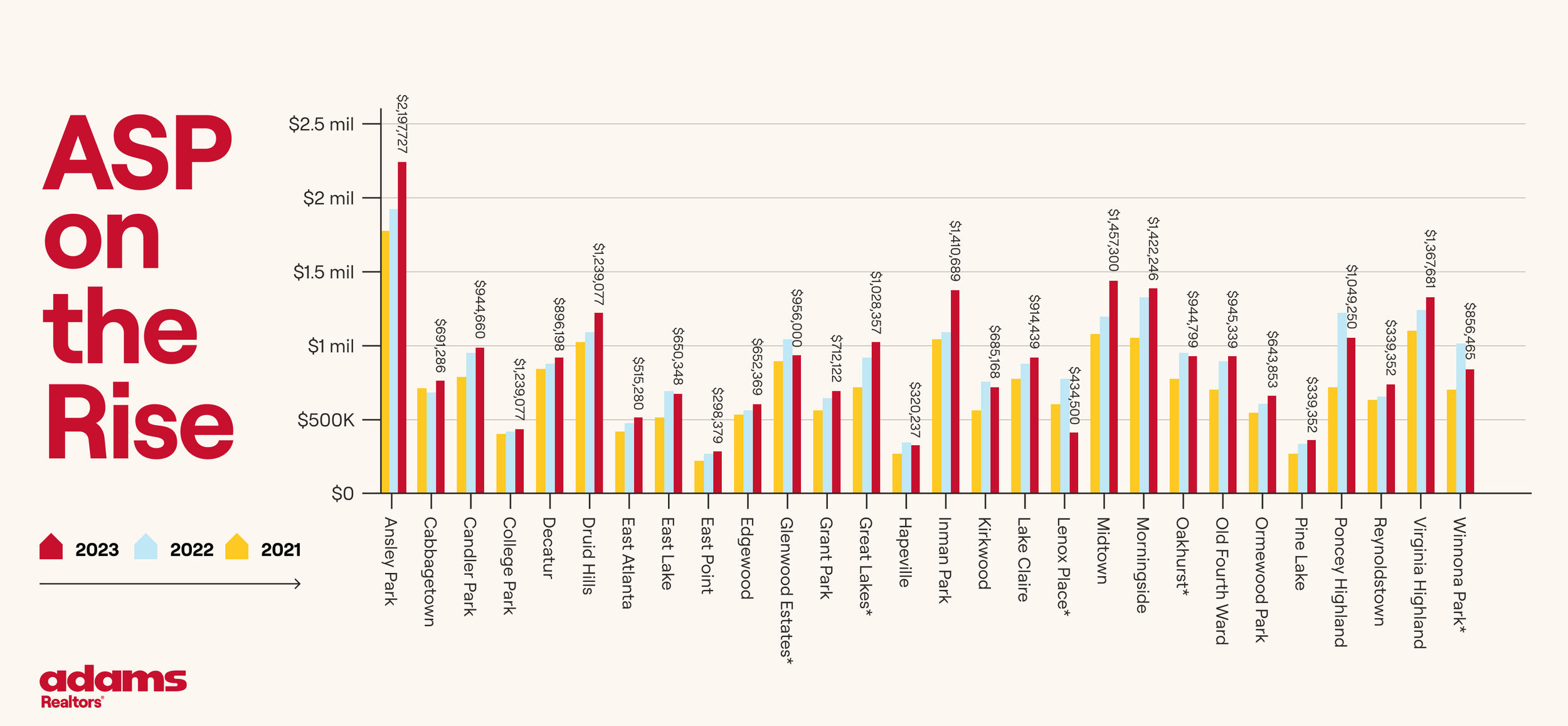

As I have said in the past, the January report is my favorite because it is the only report that compares three calendar years. The other 11 monthly reports document the last twelve months of activity commonly known as the Trailing 12. At year-end 2023, the Average Sales Price (ASP) for the market is $732,767, a 6% year over year increase over the end of 2022 and a 17% increase over the ASP at the end of 2021. Comparing the year end numbers for the last three years reflects the effect of housing inflation on the market. At the end of 2021, the Average Sales Price was $625,593. A year later in 2022, the ASP was $692,052 and at the end of 2023, the Average Sales Price had risen to $732,767, a $107,000 increase in the average price of a home in the Intown Atlanta market over the last two calendar years.

At the neighborhood level, nine communities experienced at least a 30% increase in their Average Sales Price in the last two years. Adair Park-35%, Candler Park-33%, Capitol View-36%, Glenwood Park-41%, Great Lakes-30%, Inman Park-31%, Old Fourth Ward-30%, Pine Lake-33% and Poncey Highland-30%. In terms of actual dollars, the most expensive neighborhoods lead the way in price increases since 2021. Ansley Park-$357,701, Glenwood Park-$302,764, Inman Park-$334,345 and Midtown-$393,210.

In contrast, only three neighborhoods out of 39 markets had lower Average Sales Prices in 2023 compared to 2021. Chosewood Park was down by 16% or $68,976. Lenox Place was down 42% or $310,042 and Oakland City was off by 3% or $8,293. A special note regarding Lenox Place. According to the First Multiple Listing Service, Lenox Place only had 2 sales in 2023 and both were modest homes, typical of most of the neighborhood’s housing stock. In prior years, expensive, infill houses tended to skew the neighborhood’s Average Sales Price upward.

I don’t have any earthshaking predictions for the 2024 Intown Atlanta market. I do feel like mortgage interest rates will fall below 6%. Lower interest rates might trigger “move up” buyers to put their current homes on the market which will increase the inventory of homes for sale. I expect that home prices will continue to rise because demand will continue to exceed the supply of available homes. Savvy buyers, looking at price appreciation in most of the neighborhoods over the last few years, will purchase homes to lock in a price this year and refinance their loan when the interest rates fall rather than sitting on the sidelines hoping for lower interest rates and watching prices appreciate in their target neighborhoods. Being an optimist by nature, I expect 2024 to be a good year for residential real estate in Atlanta’s close-in communities. Please let me know if you have any questions.