February 2023 Intown Atlanta Market Report

By Bill Adams, Founder, Adams Realtors & Adams Commercial Real Estate

Welcome to the February 2023 Intown Atlanta market report. This month, I’ll review the numbers and give some examples of the financial reality of purchasing a home in this market.

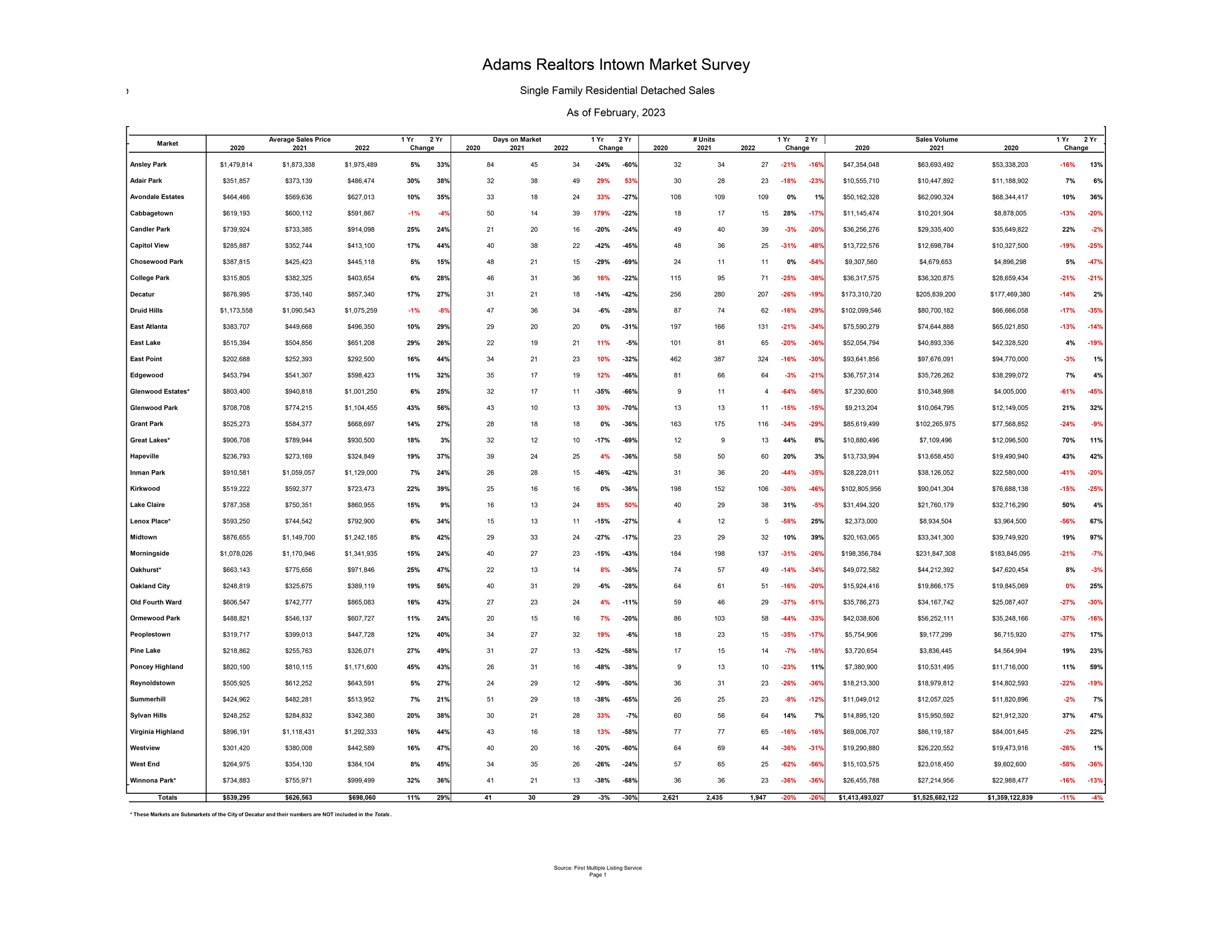

First, let’s look at the numbers: This month the Average Sales Price for the overall market is $698,626, an 11% increase over the last 12 months. The Number of Days on the Market has edged up by one day over the last month to 29 days, which is one day less than the average for February 2022. The Number of Units Sold continues to fall with 1,942 homes sold over the past year, a 20% decrease in sales volume.

I attribute the drop in the number of sales to both the lack of supply and the increase in home mortgage interest rates. As I have stated in previous reports, our data is based on the numbers from the past 12 months, a Trailing 12. Therefore, this report reflects the single-family residential market from February 2022 through January 2023. Seven of the 12 months in the report were months where interest rates rose. As mentioned above, the interest rate spike negatively affected sales volume. It does not appear to have had the same effect on prices.

Several months ago, I wrote about markets where the Average Sales Price exceeded one million dollars. This month, nine of our markets were in this category. Another four markets had an Average Sales Price of over $900,000. Thus, 13 of the markets, fully 1/3 of the markets in this report, have home sales that average over $900,000.

Let’s look at the reality of purchasing a $900,000 home: If one were to purchase a $900,000 home, with 20% down, your mortgage would be a “conforming loan” at an interest rate of 6.125% with a term of 30 years. A down payment equal to 20% of the purchase price would be $180,000. Tax prorations and loan costs would add to the down payment amount. Under these circumstances, a mortgage payment would be $4,373.00 per month, not including taxes and insurance. To qualify for this loan, a borrower would have to have an annual income of around $210,000 along with substantial savings to make the down payment.

In another example, a buyer that purchased a home at the market Average Sales Price of $698,626 with 10% down at the same 6.125% interest rate would have a monthly payment of $3,818.30 and would have to make a down payment of $70,000. In this case, the borrower would need an annual income of around $180,000. In 2022, the Area Median Income (AMI) for the Atlanta Metro Area was $95,700. As you can see, there is a large disconnect between the AMI and the household income needed to purchase a home in many Intown Atlanta communities. These numbers are a good illustration of the affordability crisis affecting Atlanta and many other cities throughout the country.

Need help navigating the Intown Atlanta housing market? Please reach out to us at 404- 688-1222. Questions or comments about this market report? Reach me at wtadams@adamscre.com.